05 October 2020

2020 September | All PeerBerry indicators grew. Interest rates have increased

Another great month has passed. All PeerBerry performance indicators grew up last month. The interest rates have also increased, which was highly expected by our investors.

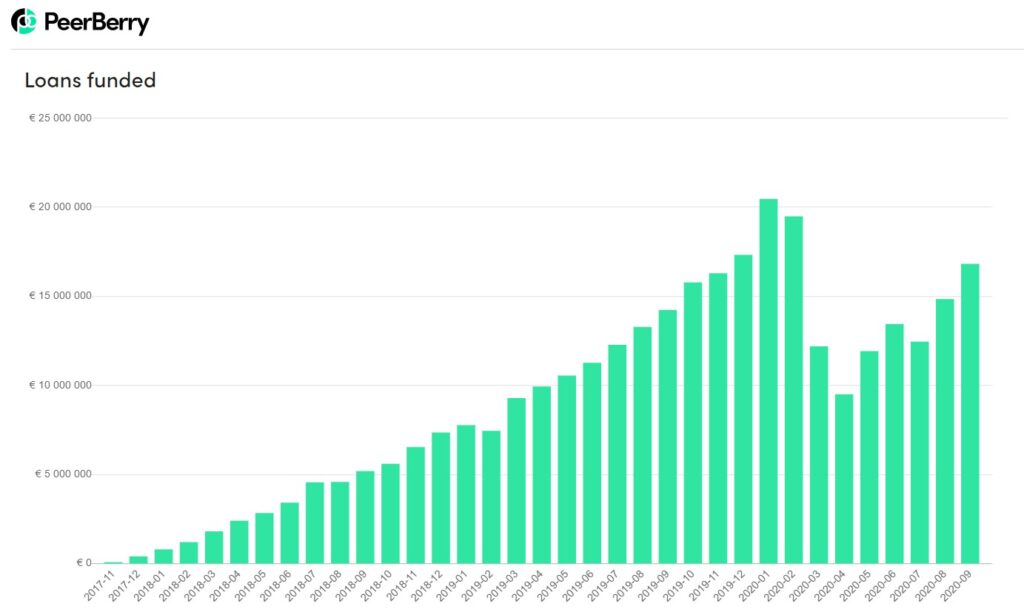

According to PeerBerry results, September was the most productive month in terms of funded loans on the platform since February. The amount of funded loans reached 16.82 million EUR and was by 13,3% higher than in August. According to this indicator, PeerBerry holds strong positions among the sector leaders in Europe.

The main PeerBerry figures for the end of September 2020

- the total loan volume originated since inception – 323 026 501 Eur (+5,5% growth)

- the loan volume originated in September – 16 816 270 Eur (+13,3% vs August)

- the number of loans originated in September – 117 286 (+13% growth vs August)

- the interest earned by investors since inception – 3 539 844 Eur (+4,9% growth)

- the average annual investment return at the end of September – 10,98% (+0.84 pp vs August)

- the average nominal interest rate of loans originated in September – 10.17 % (+0.47 pp vs August)

- the number of investors at the end of September – 26 347 (+872 new investors per month)

“Investment security is our number one priority and we are happy to provide stability for our investors. The share of overdue loans on the PeerBerry platform is around 15-20% and has remained stable since the spring. And this is one of the best indicators in the entire P2P market. This shows that even in the most difficult market conditions, our partners are able to manage risks professionally, which guarantees investment security for our investors” – explains Arūnas Lekavičius, CEO of PeerBerry.

“Another good news for our investors is that interest rates on investing in loans have increased at the end of September. Our partners reviewed their lending plans for the last quarter of this year. Higher volumes of new loans are planned for the Q3 than in August-September, which also leads to a higher return on investments. Of course, we need to remain vigilant and closely monitor the situation in international markets, but we hope that the pandemic will not have a more serious impact than we have seen in the last six months” – says A. Lekavičius.

PeerBerry investors survey – part 1

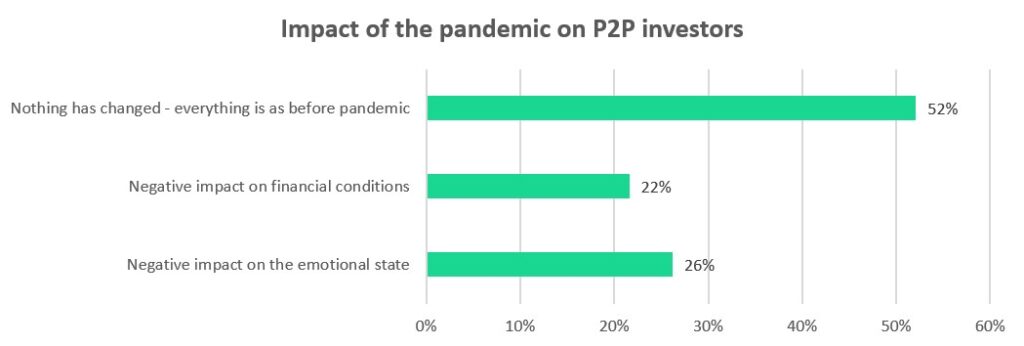

2,975 investors from 44 countries responded to the PeerBerry survey conducted on 24-28 September.

The first part of the survey data is published on our Blog and you can review it here.

It is gratifying that more than half of the investors surveyed did not feel any impact of the pandemic.

Highlights for October 2020

Higher volumes of new loans on the platform are planned for October. A larger share of loans with interest rates of up to 12% is also planned.

PeerBerry is constantly working on improvements to the platform. October is mostly dedicated to improvements in the Auto Invest tool. We believe that most of you already noticed that Auto Invest works much faster than before. Speed and efficiency are the most important part of the Auto Invest update. In October also some new filters and new features of filters will be introduced.